ESG Model

Double Materiality

We are pleased to announce that Fondo de Fondos has updated its materiality study conducted in 2023. This update includes the adoption of double materiality, an approach that reflects both impact material and financial materiality.

In an increasingly regulated and sustainability-oriented investment environment, Fondo de Fondos faces the challenge of integrating environmental, social, and governance (ESG) criteria into its strategies and investment portfolio. The Double Materiality Study is key to ensuring that our investments are resilient in the long term, aligning with international best practices and emerging regulations such as IFRS S1 and S2 and the Sustainable Information Standards (NIS) issued by the Mexican Council for Financial Reporting Standards, A.C. (CINIF).

Why did we make the decision to update our Materiality Study?

1. Identification of Financial and Impact Risks and Opportunities

Double materiality allows us to assess how ESG factors financially affect investments and, at the same time, how investments impact the social and environmental context.

In sectors such as energy, infrastructure, and real estate, understanding these risks and opportunities helps you make informed, timely decisions and avoid assets that are vulnerable to regulatory or climate change.

2. Stakeholder Identification

3. Regulatory Compliance and Access to Sustainable Financing

Institutional investors demand greater transparency and commitment to sustainability.

At Fondo de Fondos, we strengthen our position by aligning ourselves with the Principles for Responsible Investment (UN PRI), the standards of the International Sustainability Standard Board (ISSB), and the principles of the Global Compact.

4. Diversification and Resilience in our Investment Portfolio

The double materiality methodology allows for the identification of high-risk and high-potential sectors, promoting investments in clean technologies, resilient infrastructure, and sustainable business models.

It helps identify assets that could lose value due to environmental restrictions, changes in tax regulations, or climate vulnerability, meaning it allows us to avoid the possibility of them becoming stranded assets.

5. Industry Reputation and Leadership

Fondo de Fondos has served as an anchor investor in Mexico's private equity industry for more than 18 years.

Incorporating double materiality into our investment strategy reinforces our commitment to sustainable economic development, attracting investors with a long-term vision.

Our Materiality Matrix

Adopting double materiality gives us a greater opportunity to optimize profitability, mitigate risks, strengthen our leadership in the private equity industry, and promote sustainable investment in Mexico.

Strategy

Fondo de Fondos: Investing with Purpose, Creating a Sustainable Future

At Fondo de Fondos, we know that smart investing is not only measured in financial returns, but also in real positive impact.

Our commitment is clear: to transform the future with sustainable investments that generate economic, social, and environmental value.

Our strategy is based on three pillars:

Our Risk Management

Within the operation of Fondo de Fondos, we have identified the main risks, which include:

Operational risk

The potential loss due to failures or deficiencies in internal controls, errors in the processing and storage of transactions or in the transmission of information, as well as adverse administrative and judicial resolutions, fraud or theft, and includes, among others, technological risk and legal risk.

Counterparty risk

Counterparty risk originates in the investment process, which is the principal activity of Fondo de Fondos. It is defined as the inherent risk of financial loss to which the institution is exposed when it commits and delivers monetary resources to various Private Equity/Entrepreneurial Fund managers. The mitigation of this risk is achieved through selection, verification (Due Diligence) and decision-making processes by the Investment Committee and the Board of Directors.

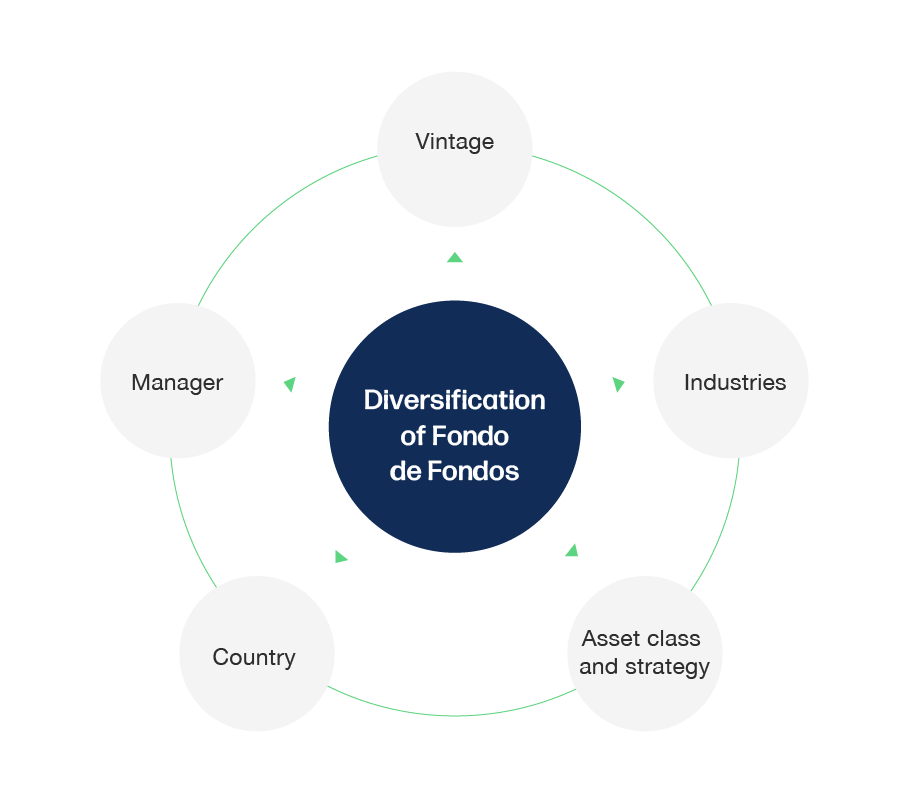

Portfolio diversification risk

An investment in Fondo de Fondos is a strategy that may have a significant impact on the improvement of the risk profile of an investment portfolio. This option offers a comprehensive diversification by pooling different investment funds into a single vehicle. By spreading resources across a variety of underlying assets, geographic regions and asset classes, the exposure to specific risks is reduced and market fluctuations are smoothed out. This comprehensive diversification is essential to optimize the balance between portfolio risk and return, because it minimizes the probability of significant losses and provides investors with greater comfort in times of market volatility.

Business Model

Our strategy has resulted in a highly diversified portfolio that encompasses multiple sectors, including

Private Equity, Venture Capital, Energy, Impact Investments and Special Programs. The investment thesis of the Funds

focuses on key areas such as services, consumer products, information technologies, software, IT

services, financial and credit services, agriculture, food production, and energy, among others.

Furthermore, we manage alternative assets, in accordance with international best practices. This has

allowed us to generate value for our investors and establish strategic alliances with the objective of

boosting the risk capital ecosystem in Mexico.

Affiliations

On December 2020, Administradora CMIC, S.A. de C.V. joined the United

Nations Global Compact, assuming the commitment to annually present its Communication of

Progress (CoP). The purpose of this initiative is to report the progress achieved during the

specified period in the four fundamental pillars of the Compact:

Human rights - Labor -

Environment - Anti-corruption

Fondo de Fondos emphasizes its commitment to sustainable and responsible investment by joining the United Nations Principles for Responsible Investment (UNPRI) on July 3rd , 2019. This action reflects its determination to adhere to best practices in this field, prioritizing not only financial performance but also the social and environmental impacts of its investments. Its adherence to UNPRI illustrates its comprehensive investment approach, aiming for economic benefits while contributing to the well-being of society and the environment.